-

Tax Schedule Tax Exempt Mm In Quicken For Mac카테고리 없음 2020. 1. 25. 07:35

Quicken users who also use Mac Operating System. If you have any questions or need assistance with your Quicken or QuickBooks setting modifications,. CrashPlan® for Small Business makes backing up and restoring files from all your devices, including external hard drives, fast and easy. Try CrashPlan and get unlimited storage from the start. Get started in minutes.

Quicken and Quickbooks Instructions Quicken & Quickbooks Conversion Instructions FMFCU is introduced its all-new Online Banking on September 4. To continue using Quicken, you will need to complete a simple account deactivation and reactivation process. Documents detailing how to complete this process are listed below based on the product you are using. PLEASE BACK UP YOUR FILES PRIOR TO AUGUST 30 IN CASE YOU MUST RESTORE. CONNECTION DEFINITIONS. With Web Connect you can download your transactions directly from Online Banking and import them into Quicken.

With Express Web Connect, Quicken communicates directly with Online Banking within the Quicken/Quickbooks software.

Quicken is the best known personal finance software. Best is it the best? We put it to the test in our Quicken 2018 Review. Here, we’ll walk through the general pros and cons of Quicken, who its best for, costs, new features, add-ons and a walk-through of features for Quicken 2018. Is one of the big names in the world of personal finance, partially because it’s been around for so long. Quicken was first released in 1983.

Its first version ran on DOS! So it’s something of a dinosaur among budgeting apps. With that said, Quicken still has a lot going for it, though it’s not the right financial management tool for everyone. Pros and Cons of Quicken With a tool that’s been around since the 80’s, there’s a lot to love and a lot to dislike. Quicken definitely has its quirks, and it’s not a great fit for everyone.

But it also has some great things that long-time users absolutely love. Here’s a quick list of pros and cons to consider. Quicken Pros.

Doesn’t have to sync directly with your bank. If you don’t like the idea of a budgeting tool connecting directly with your bank accounts, Quicken doesn’t have to.

But you can also manually enter transactions. Or you can download a Quicken or CSV file of transactions from your bank. Then you can upload them to Quicken in just a few seconds. Easy-to-use visuals.

I don’t find Quicken’s visuals to be the most appealing in the world of budgeting tools. But they’re not terrible. You can get a quick breakdown of where you are on your monthly budget categories, where you spend most of your money, and more. Total control over both budget and investment data. Many other tools, such as Mint and Personal Capital, are more focused on either budgeting (Mint) or investing (Personal Capital).

With the right version of Quicken, you can get a robust management option for both. Debt reduction tools built in. Quicken has built-in tools for reducing your debt.

It will let you project out the impact of extra debt payments, including how much you’ll save in interest. Bill tracking and reminders. You probably already from many of your credit card and utilities companies. But you can move them all into the same interface with Quicken.

It will also help you find your bills when you set up your account. Projected balances based on upcoming bills. One of the cool things about putting in your bills with Quicken is that it lets you figure out how much money you will have in the future, based on your upcoming bills. Automatic net worth tracking. If tracking your net worth is important to you (and it!), Quicken makes it easy. You’ll actually get a net worth calculation on the sidebar that changes any time you make changes or import new transactions.

Mobile app with alerts. Quicken also offers a mobile app. It’s not the slickest one in the bunch. But it will let you enter transactions and check out your accounts on the go. Quicken Cons.

Relatively high costs compared with some tools. Quicken is to Intuit’s free tool,. It’s basically a more robust version. But it costs anywhere from $40 to $80+ per year, depending on which version you buy and whether or not you get a discount. Doesn’t sync with all banks easily.

I had trouble syncing Quicken with my Huntington National Bank checking account. I’ve had trouble with Huntington with other tools, as well, just for full disclosure. But the problem with Quicken is that you have to purchase it before you can try to sync it with an account. So you may want to dig around online to be sure it’ll work with your bank if syncing transactions is important to you. Can be overwhelming to begin using. Probably the biggest issue for new Quicken users is sheer overwhelm. It includes a lot of different tools and information.

Getting it set up can take a while, and learning to use it efficiently can take even longer. If you want a full picture of your finances, this can be worth your time.

But if you just want to spend ten minutes a week tracking your budget, it’s probably not your best bet. Not as smooth as some interfaces. Quicken has always left something to be desired with its interface, I think. It’s just not as pretty or as intuitive as some budget tool interfaces.

With that said, it’s gotten better since I first started reviewing it. It’s cleaner and more intuitive now than it used to be.

Not available on the cloud. Perhaps the biggest drawback for me as an on-the-go Millennial with several different devices is that Quicken has to be installed on my computer. So I can only fully access it in one place, unless I install the software on multiple computers. This can get frustrating. Frankly, I’d rather use a tool I can access from anywhere with an internet connection. With that said, it could be nice that you don’t have to be connected to the internet to perform some tasks on Quicken. Who is Quicken For?

Usaa Tax Exempt Mm

Now that you know the basic pros and cons of Quicken, you might already have figured out whether or not it’s for you. But here are some people I think might benefit most from Quicken. The Detail-Oriented If you really want visibility into every aspect of your financial life all in one place, Quicken may be the best tool for you.

Yes, other budget and have similar functions. But few have the available tools for debt payoff, balance projections, and long-term planning that Quicken offers. As a detail-oriented person, you may be likely to spend time digging into what Quicken offers. And this may make it worth your while. Once you get your systems in place and start using this tool, it will provide you with details on the minutia of your entire financial life. Business Owners Of course, Quicken is still a go-to for business owners.

Even larger businesses and nonprofits use their robust tools for managing the business budget. But I think it’s the ideal tool for small business owners and entrepreneurs. That’s because it can simultaneously track your business finances and your personal finances. It’ll keep things separate for you, but you can use the same tool to do both. And that could save you time and headache in the long term. Investors who Budget As I’ve mentioned before in this review, many other tools focus on either investing or budgeting.

Is an excellent tool if you want a detailed view of your investments and a sky-level view of your spending. You can certainly use it for a more detailed budget, but it’s not built for that as much. Mint, on the other hand, will track your investments. But it gives you a detailed budget and an overview of your investments.

Quicken combines detailed budgeting and detailed investing, so that you get both in one tool. So if you’re an investor but you also prefer to operate with a detailed budget, Quicken might be the tool for you. Those With Security Concerns Increasingly, budgeting and investing tools sync directly with bank and investment accounts and store data in the cloud. Quicken can be set up to do neither. It can live exclusively on your desktop. And you can pull in data manually or with downloaded transaction logs from your bank. If you’re concerned about the security of other systems, Quicken can give you the financial management tools you need while allaying some of your security concerns.

Quicken 2018 Features Quicken comes out with a new version each year. You can upgrade your older version, or you can just get started with the latest version.

Here’s what you’ll find with Quicken 2018. New Features and Costs for 2018 One of the biggest is Quicken’s expanded Mac options. For the first time, Mac users can decide between different products based on what suits their needs. Overall, Quicken is supposed to just work better for Macs than it has in the past.

Here are a couple of other new features:. Membership Based Program: Instead of purchasing an upgrade every year, Quicken members pay an annual fee and automatically get upgraded each time a new version rolls out. Online Billing Access: Quicken now integrates with more than 11,000 billers, and it lets you download PDF copies of your bills right to Quicken. You can even track and pay bills from Quicken.

Direct Report to Excel: If you want to track your budget and financial performance over time in Excel, Quicken can now directly export reports to this program. Better Investment Analysis: This feature is constantly being improved, and it’s supposed to be even better for 2018. Dropbox Partnership: All new users will get an extra 5GB of data from Dropbox to back up their Quicken data. Those are the new and updated features you can expect with the latest version of Quicken. So what does it actually look like and do? I imported a few weeks’ worth of transactions to give you a quick walk-through of the latest interface.

Home The first tab on your Quicken interface is the Home tab. This gives you a quick summary of your current financial situation. The good news is that you can customize this screen. You can show your spending first or prioritize your investments. It’s completely up to you. When you start up Quicken, the home screen will give you different quick-start options, as you’ll see below. You can see that Quicken wants me to set up my bills in the system.

And as you’re getting started, you can use the built-in wizards to walk through these processes step by step. The Customize button lets you choose exactly what appears on your home screen and in what order: From the Home screen and every other screen, you’ll see the navigation bar on the top and one on the left.

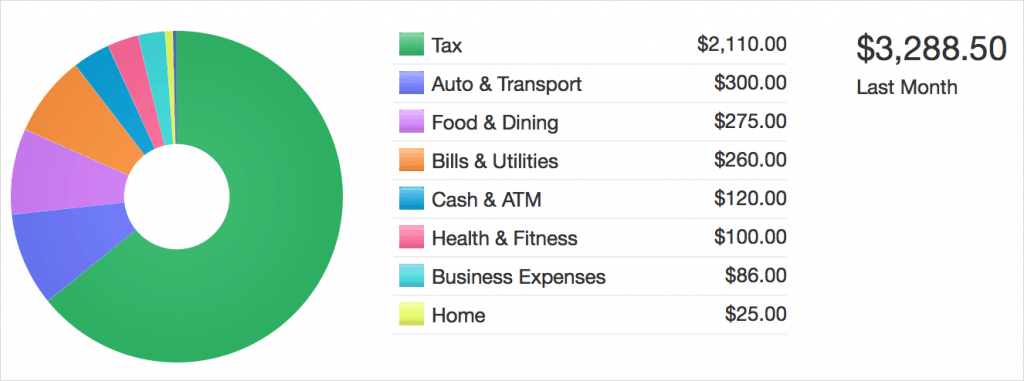

The bar on the left includes your current net worth at the bottom. Spending The second tab is where you’ll go to track your spending. Quicken will automatically break down imported transactions into categories. But you can always recategorize transactions. You can also change the categories here, depending on how your budget breaks down. One of the nice things about this screen is that you can look at spending in different chunks. The drop-down menus at the top let you look at spending only from certain accounts, or from certain periods of time.

So you can see what categories you spend on from your checking account versus your credit card, for instance. Keep in mind that this data could be totally inaccurate as it comes in. Quicken will alert you when there are uncategorized transactions. But you may want to double-check the categories of every transaction as it imports. Sometimes Quicken just guesses wrong, which can throw your percentages way off.

Bills and Income This is probably the feature I like best about Quicken versus other budgeting options. You can sync it up with your billers, such as Verizon or AT&T. It takes some time to sync up with all your bills. But once you do, Quicken will put them into a calendar view. Then it’ll tell you what your account balances should be based on your upcoming bills. You can do the same thing with planned income.

If you have a salaried job with regular paychecks, tell the system when you’ll get paid and how much. Again, it uses this data to project out your account balances. If you’d rather, or if your bill provider isn’t available, you can put in your bills manually.

I can, for instance, put in how much we need to pay for daycare and when that’s due each month. Again, these future bills will show up on your calendar, and you’ll get a projected account balance based on your bills. I had to fiddle around with this interface for a bit before I could figure out how to use it properly. But once you have it, syncing up your bills shouldn’t take all that long. It’s just a matter of making sure you put them all in so that your projected balance isn’t too far off. Once you put the bills in, you can mark them as paid as they get paid off. This will happen automatically if you’re synced to the biller.

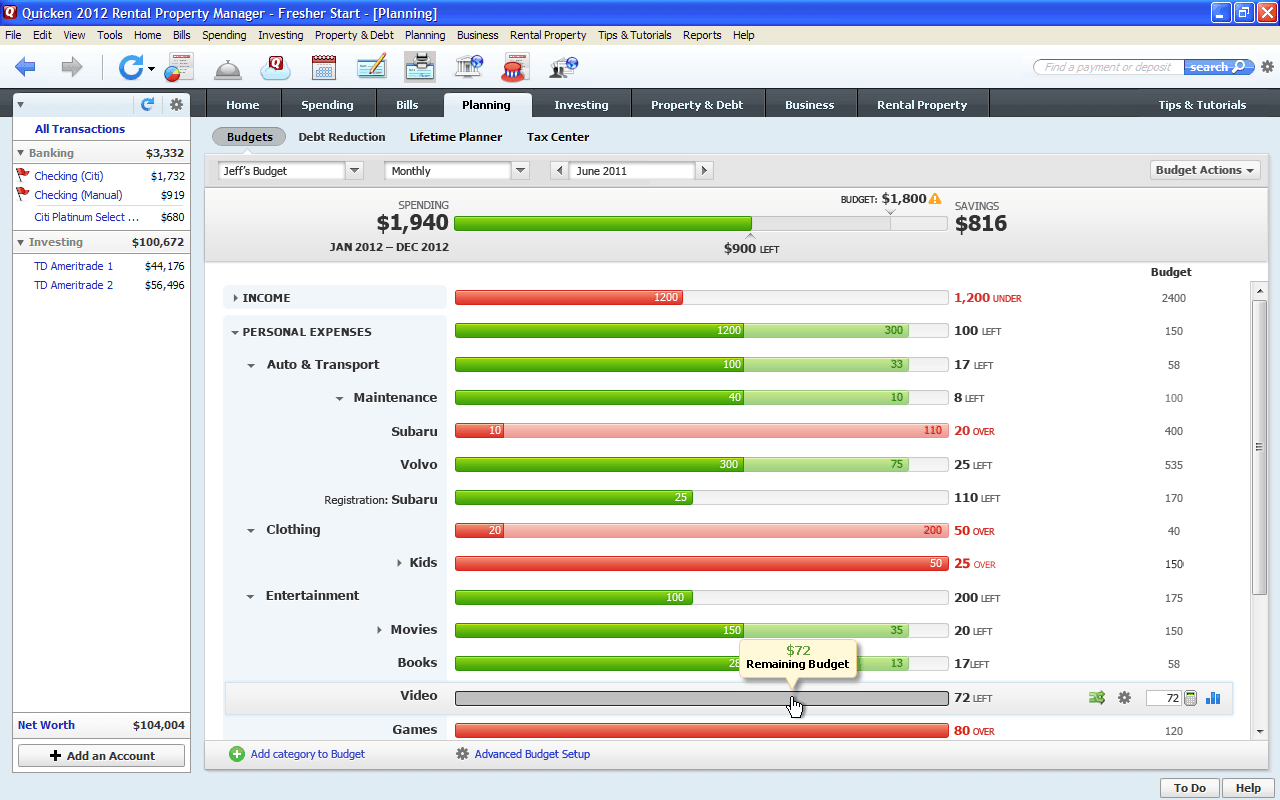

Financial Planning Quicken’s robust financial planning tool includes several options, such as budgeting, tax planning, and long-term planning. I dug into the budgeting tool with Quicken. As with the rest of the software, this wasn’t the most intuitive budget builder I’ve ever used.

You have to first create the budget and then use the “Budget Actions” tab to decide which categories to add. But they offer a bunch of categories, so you can create quite a detailed budget. Once you add the categories, you have to edit them individually to change their amounts.

It’s really kind of a pain. But here’s something I do like: you can decide at the beginning of the year how much to budget each month for each category. If you like planning way ahead, this is a great option.

Not many online budgeting tools will let you plan an annual budget or plan so far into the future. Quicken also includes on this tab is Debt Reduction calculator. This lets you keep track of your current debts and create a plan to pay them off.

It helps you project out how much you need to pay towards your debts to get them paid off, and it’ll show you how much interest you can expect to pay over time. The Savings Goals tab allows you to do the same thing except for savings. You can save for specific goals, such as an upcoming vacation or a new car. This section is meant for short- and mid-term goals. The investment tracking option is more for long-term goals like retirement and overall financial freedom. Quicken also offers a Tax Center.

You can input your tax information, and it will tell you your projected tax return or taxes due. You can also assign expenses to various tax categories. This is helpful if you’re a small business owner or if you run a side gig with tax-deductible expenses.

You can also use it to track things like charitable donations. The Lifetime Planner tool is, as you might guess, a big overview of your entire financial life. You have to first answer several questions, and then Quicken helps you project your finances out over years and decades. It’s a high-level tool that can be helpful for gaining some additional insight into your financial life. Add-Ons If you’re already using Quicken, you should consider adding on some of its additional services. The most worthwhile are probably the bill paying services.

Tax Schedule Tax Exempt Mm In Quicken For Mac 2016

This service is free for Premier and above users, or it costs $9.95 per month for others. It lets you pay your bills directly through Quicken. This can just make staying on top of your bills simpler. Other services to consider include Quicken’s Social Security Optimizer and their premium support for Windows users. There may be other tools online that can replace these, though, so be sure you do your shopping around. You can also purchase the Quicken WillMaker tool through the program.

I’ve reviewed this elsewhere and think it’s a reasonable service for those with simple wills. Other Features Probably the best newer feature for Quicken is the ability to set up mobile accounts and get alerts. You can set up alerts for different account changes or upcoming bills, for instance. Most bank and investment accounts these days also let you set up alerts. But putting them all in one place might be helpful as you organize your financial life. And, of course, provides lots of documentation and tutorials.

It’s one of the longest-running financial management tools around. So you’d expect it to have plenty to say about how to manage your finances.

In the “Tips & Tutorials” section, you can get information on Quicken, specifically, or broader information on getting out debt, setting savings goals, and more. Not sure if Quicken is right for you? Check out these. Chuck Quickens new policy of requiring a yearly membership is a big ripoff for consumers. I used to be able to decide when I wanted to upgrade my current version of Quicken based on enhancements and features that were updated each year. Most of the time, I chose to upgrade every other year.just to stay current.

Now they require you to upgrade every year or they turn off their banking and investment download feature.meaning you have to manually download your information from your bank(s). Quicken has decided that more money takes precedent over making personal finances easier. I will be looking at other software options. Jack Feder I have used this product for a couple of decades.

They have added features, but changed the functionality a little. I can not switch as my data is captive, but after a recent upgrade, there were a few corruptions to my DATA! The opening balances were changed by the upgrade process. This is not acceptable and I only found out about it when I could no longer balance my accounts. Accounting software the corrupts data is less than worthless.

Vanguard Tax Exempt Mm

Also, when I had problems with the automatic connection features, support wasted a day by being useless, telling me I had to reinstall everything etc. In the end, after escalation, it turned out they said they had trouble communication with some institutions, but they did not even notify their support people and the setup wizard is poorly written so you can’t tell. Now, I am trying to set up the upgraded version so that it can print cheques.

Do you know that in the format if you select “blank line before payee” that it no longer prints the adress of the payee? If you get rid of the blank line, the adress prints, even though the adress is only 3 lines and does not fill up the box. Based upon my previous dealings with their tech support, I won’t even bother notifying the. I can’t waste the day. It is better just to warn people about this product. Steve Antonoff I’ve been using Quicken for almost 30 years (Quicken for DOS starting in 1989, before Windows). My habit, up until now, was to upgrade every other year since financial institution interfaces lasted for 3 years with each upgrade.

I’m going to wait until 2019 comes out before I upgrade, and then I’m going to take a look at other programs before I commit to an annual purchase for an unreliable product. To me, the biggest issue with Quicken is the “fragile” data base. I admit I haven’t cleaned out my Quicken file in about 12 years now (accounts have data going back to 2006) so I’m probably stressing the file more than I should. But a fully functional financial program should use an SQL database with new tables for each year (or fiscal year). An annual closeout, that closes the previous year and starts a new one, should happen automatically on the first entry for the new (fiscal) year.

I had a situation recently where I withdrew a large chunk of money from a Savings Goal. The withdrawal from the goal worked but Quicken must have crashed before it put the money into the originating account, leaving me $thousands short of cash until I found the error. Recently (starting in July), Quicken started duplicating some downloaded transactions in multiple accounts: I have 4 accounts with my investment broker and when a dividend was received in 1 account, Quicken put it in 2 others, even though those accounts didn’t have any of the stock that was paying the dividend. I discovered this in August through a reconcile process that wouldn’t balance: Quicken had $hundreds of “bogus” transactions that had to be manually deleted. I don’t know if this was the fault of Quicken or the financial institution. I now verify my Quicken file at least monthly to find and eliminate errors.